40% of the nation’s wealth, is controlled by the top 1% of the wealthiest individuals. While considering this wealth disparity, consider taxation because taxes affect everything in your life and certainly your economic freedom. The Sustainable Tax proposes a replacement of the U.S. income tax system to mitigate this wealth disparity and more importantly maximize your economic freedom.

A paradigm shift in taxation called the Sustainable Tax is briefly outlined that includes:

- the definition of the Sustainable Tax

- how it works

- why is it needed

What is the Sustainable Tax?

The Sustainable Tax is tax on the resources that produce goods and services. Technically speaking, these resources are most of the same capital assets depreciated for allowance under our current tax code. Simply speaking, it is a tax on the stuff that makes stuff. For example, taxable assets would include factories, machinery, transportation fleets, telecommunications companies, power generation companies, timber land, and gas/oil companies. Taxes are paid by those individuals that control these resources. It eliminates all transaction taxes such as income taxes, payroll taxes, capital gains tax, estate tax, gift tax, and excise taxes. The sustainable tax scraps all of the exemptions, deductions, and tax credits from the entire tax code. Once successfully implemented at the federal level, it could replace all tax systems in the United States.

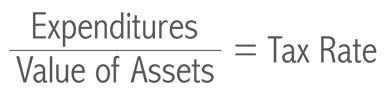

The Sustainable Tax formula calculates the tax rate as a ratio of federal expenditures (spending) and the value of taxable assets as follows:

Total federal expenditures are what the government spends in accordance to the budget and borrows by unforeseen deficits. Social security, Medicare, military, and infrastructure are examples of budgeted expenditures. Borrowing includes budget shortfalls from tax avoidance, tax evasion, and unforeseen expenditures such as natural disaster relief and war. Taxable assets are the tax assessed value of those assets that fall under the Sustainable Tax provisions. The asset carries the expenditure.

How Does the Sustainable Tax Work?

To provide perspective, in 2016 the Federal expenditures were approximately $4 trillion and the value of taxable assets was estimated at $80 trillion. Note that the federal government only collected $3.5 trillion leaving a $474 billion deficit. The Sustainable Tax formula includes the prior tax year deficit to avoid future debt and includes a percentage of the current federal debt to pay down the existing debt in a predetermined period. Under these economic conditions, the Sustainable Tax rate at the federal level would be as follows

= 5.00 %

The $80 trillion in the calculation above does not account for financial business, farm, faith sector, and nonprofit assets (503c organizations) since they are not included in the federal government’s balance sheet (Z1 form). It is estimated that the value of total taxable assets would double if these institutions’ assets were included. The estimated value of assets in the U.S. is as high as $400 trillion according to Forbes magazine. This seems reasonable since we are the wealthiest nation in the world. Considering these economic conditions, the Sustainable Tax rate would be 1%.

It has just demonstrated that a 1-5% Sustainable Tax can fund the federal government’s expenditures 100%, with no additional debt. Most of the owners of these assets would pay less tax and most Americans would pay zero direct federal taxes because they are not required.

Why the Sustainable Tax is Needed

The Sustainable Tax is needed because the current income system is at best, inequitable, unnecessarily complex, and inefficient:

- When 45% of households and 20% of profitable corporations pay no federal income taxes you have inequity.

- When tax payers spend approximately $800 billion to $1 trillion a year for tax preparation and lost time to pay their taxes, you have too much complexity. (The current system imposes almost a $ 1 trillion mandate for Americans to pay their taxes?)

- When our current income tax system is only 85% compliant with tax collections (in the 21st century in the age of big data) you have inefficiency.

Ultimately, the current income tax system distorts economic decision making and is detrimental to the economy. Taxing money and transactions impedes the flow of money and reduces your spending power. The Sustainable Tax would have the opposite effect by increasing the rate of transactions and providing you with more spending power.

Through the voluminous tax code, tax exemptions have become devices for social engineering. Sustainable Tax.org denounces the use of tax credits, deductions, and exemptions to implement social policy through taxation. Does everyone in this room realize that through taxation, you subsidize organizations that you disagree with? A pretty famous man once said, “To compel a man to furnish funds for the propagation of ideas he disbelieves and abhors is sinful and tyrannical”. This was Thomas Jefferson by the way. Sustainable Tax.org agrees with his statement!