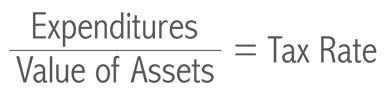

Our mission is to promote the Sustainable Tax as a replacement to the US Income Tax System. The Sustainable Tax hopes to capture the attention of all tax payers and government to use their vast resources to analyze the Sustainable Tax and elevate it to replace our current system.